Receivables Turnover Ratio Calculation Example The next step is to calculate the average accounts receivable, which is $22,500. The net credit sales come out to $100,000 and $108,000 in Year 1 and Year 2, respectively. Since sales returns and sales allowances are outflows of cash, both are subtracted from total credit sales. Financial Assumptionsįor our illustrative example, let’s say that you own a company with the following financials. We’ll now move to a modeling exercise, which you can access by filling out the form below. Accounts Receivables Turnover Calculator - Excel Model Template Low A/R turnover stems from inefficient collection methods, such as lenient credit policies and the absence of strict reviews of the creditworthiness of customers. If the accounts receivable turnover is low, then the company’s collection processes likely need adjustments in order to fix delayed payment issues. The accounts receivables turnover metric is most practical when compared to a company’s nearest competitors in order to determine if the company is on par with the industry average or not. The more customer cash payments awaiting receipt, the lower the A/R turnoverĬompanies with efficient collection processes possess higher accounts receivable turnover ratios.The fewer payments owed to a company by customers, the higher the A/R turnover.

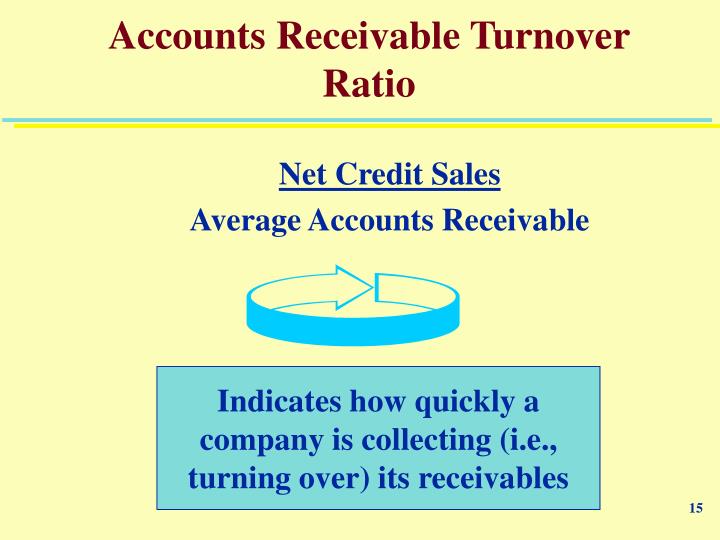

Generally, the higher the accounts receivable turnover ratio, the more efficient a company is at collecting cash payments for purchases made on credit.

#ACCOUNTS RECIEVABLE TURNOVER RATIO FORMULA HOW TO#

How to Interpret Receivables Turnover Ratio (High vs. “bad debt” – is left unfulfilled and is a monetary loss incurred by the company.

The portion of A/R determined to no longer be collectible – i.e.

0 kommentar(er)

0 kommentar(er)